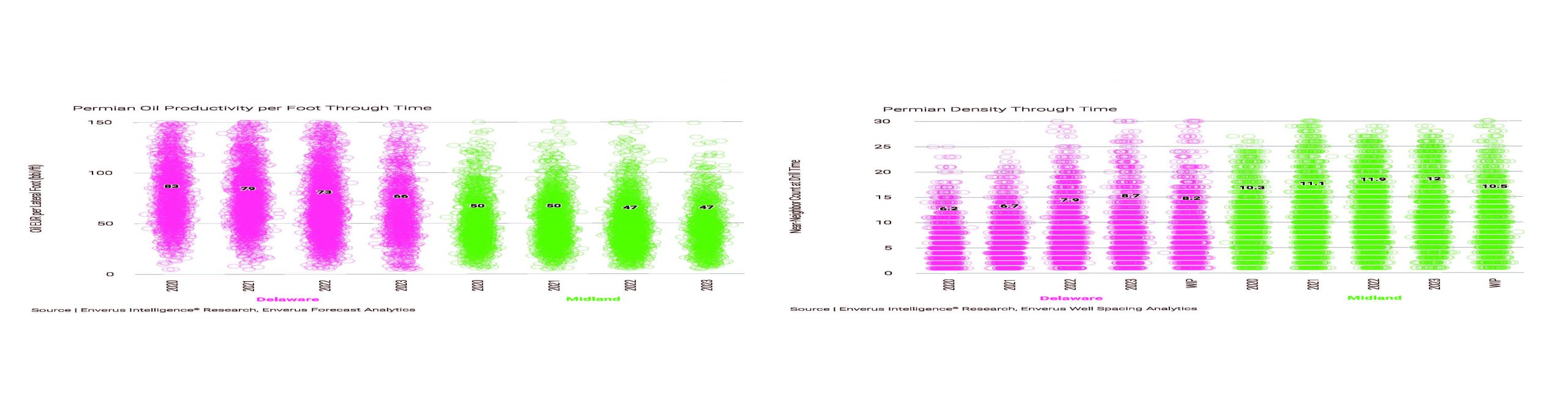

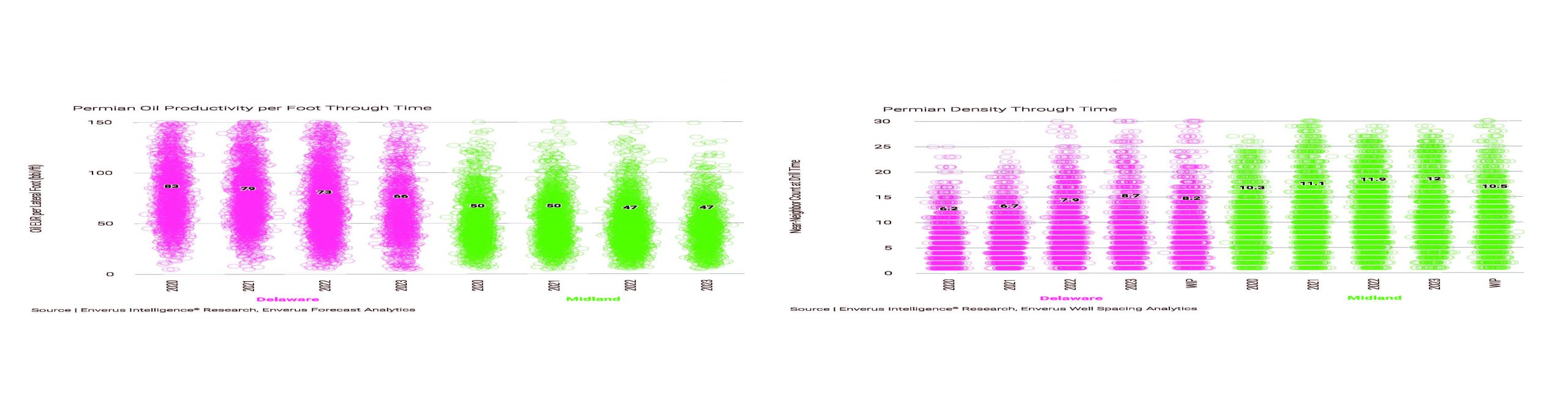

In releasing its 2024 Outlook in January, Enverus researchers and prognosticators see a decline in the huge merger and acquisition frenzy of the previous year, and they see the remaining Permian producers keeping the flow going by attacking secondary zones with new technology and procedures. Enverus Intelligence Research’s Senior Geology Associate on the Permian Team, Emily Head, highlighted some of the report’s Permian findings for PB Oil and Gas Magazine.

Emily Head

After a year that saw the Permian in the center of more than $100 billion in M&A transactions, there aren’t a lot of really big targets left, Head noted. However, while the dollars may be fewer, the acquisitions will likely continue as bigger companies see their inventory of tier one drilling opportunities slowly dwindle.

Head noted, “M&A is largely driven by inventory and a lack of high quality inventory left in the lower 48.” The desired inventory is that which can be profitable at just under $50 per barrel as West Texas Intermediate (WTI) sold at the Henry Hub, she explained.

Because the Permian Basin leads the United States in remaining sub-$50 inventory, “That’s why acquisitions have been happening mostly in the Permian,” Head noted, “and we believe that is going to be a theme in 2024.” She listed Endeavor and Mewbourne as among the prize options remaining for purchase, if they choose to sell.

It’s clear why buyers are buying, but what’s in it for the seller? Head says it’s the opportunity to monetize those assets while prices are well above that $50 threshold.

New Methods, New Fields

For the buyers to monetize those assets with production it will take some new thinking, which Enverus has seen in action. Longer laterals exceeding two miles are becoming the norm, but sometimes it takes some creativity to get those two miles. Head cited horseshoe wells, primarily in the Delaware Basin, as among the creative ideas. This method involves extending the first part of the lateral out in one direction for a distance—such as a mile—then making a broad 180˚ turn back generally toward the vertical hole. In a surface-oriented diagram of the lateral, the drill path does roughly resemble a horseshoe.

This has the effect of using one hole to double the zone access, reducing costs while connecting with more oil. A 2019 well drilled by Shell in Loving County was among the first to employ the horseshoe design.

This is not yet a wildly popular option. Head says only a small percentage of wells have been done this way, and most of them “have really been associated with infilling, smaller positions, or smaller DSUs [drilling and spacing units] that are going to be available to where they can really exploit that high-quality reserve.”

Some new zones are getting looks, sometimes for a second go-round. The Permian area of the Barnett Shale, along with Woodford and a blast from the past, the Cline Shale, are in producers’ sights these days according to Head.

“Operators are continuing to look for secondary zone development that is going to give them favorable recoveries,” she said. “In a case such as the Barnett, it’s still getting tested and we’re hoping to hone in on what the true extents of that zone will be.” Unlike its famous gas zone under and around Ft. Worth, the Permian’s version offers about 60 percent liquids and 40 percent gas, which is what’s caught the eye of the Permian’s more oil-oriented producers.

An operations technician calibrates oilfield equipment. Deloitte says technology will continue to drive production.

The Cline Shale, which engendered great excitement a few years ago before proving to be less viable than first thought, is getting a second look in today’s stretching-the-envelope environment. One issue for the Cline is its geomechanical properties “that make it a little more challenging to produce.” It, the Barnett, and the Woodford are all deep zones, reaching as far as 11,000 feet in total vertical depth (TVD), Head reported.

Shallower areas like the Clear Fork, at 7,000 feet TVD, are also getting scrutiny.

What about the Price?

Always at the top of the industry’s crystal ball is the question of price, and Enverus’s Senior Associate Josie Mills took a stab at that number, by email. The firm’s 2024 outlook predicted $90 per barrel by later in the year, so the question was asked, “Why will 2024 be different from the $100 per barrel that didn’t materialize?”

To that point Mills replied, “The price weakness seen in the back end of 2024 stemmed from supply outperformance from Russia, Iran, the United States, and Brazil. U.S. oil production was about 200 Mbbl/d higher than we anticipated. We don’t expect this U.S. production growth to continue in 2024, given the 25 percent lower rig count in 2H23 and the continued shift to lower-quality rock as core regions are exhausted. We forecast Brent prices to average about $85/bbl in 2024.”

Deloitte’s View: Technology Helps, But…

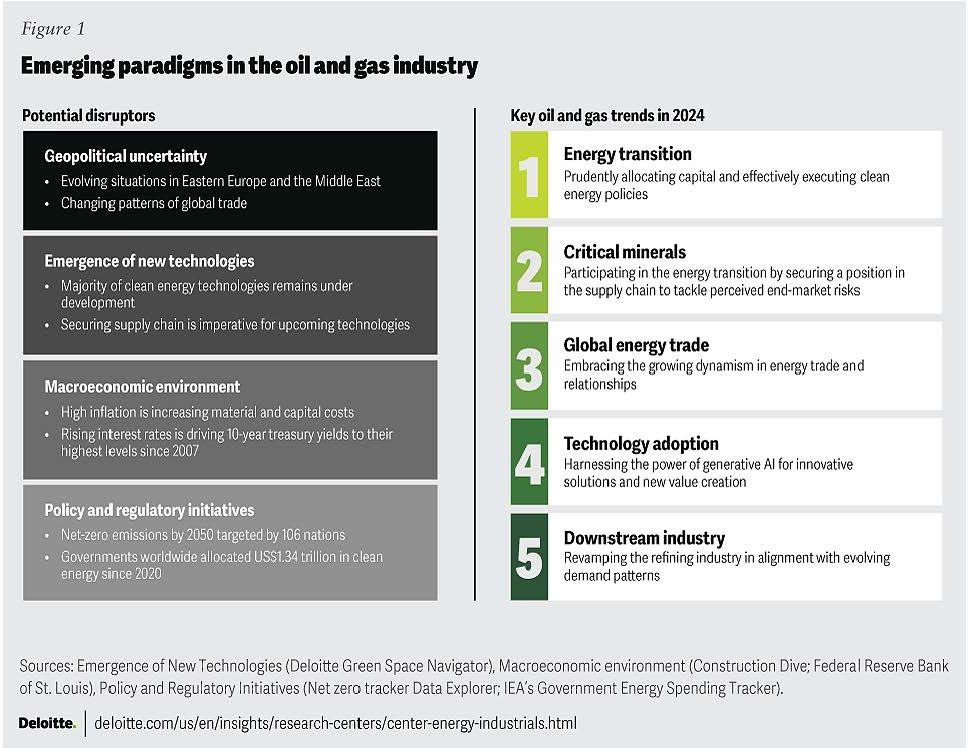

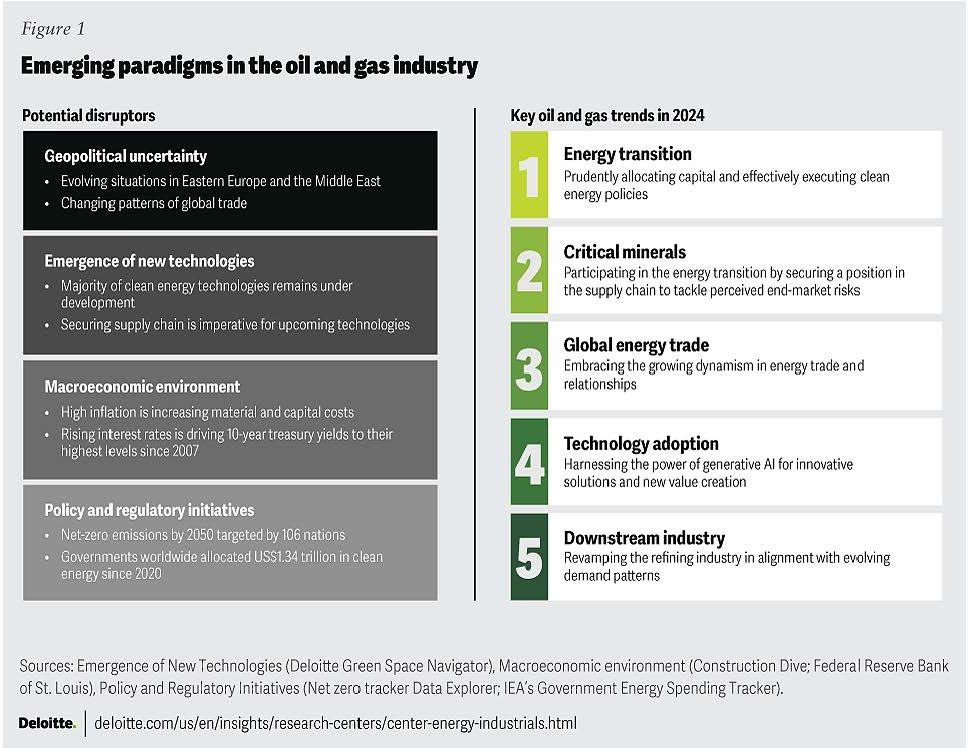

Also delivering a 2024 Oil and Gas Outlook was research firm Deloitte, who also recently promoted Teresa Thomas to the position of vice chair, U.S. Energy and Chemicals leader. Thomas provided Permian-focused input in an email interview.

The company’s Outlook discusses the effects of international issues, including the loss of Russian crude, on oil prices—which can significantly affect E&P budgets across the globe, including the Permian. On that topic, Thomas pointed out that the era of significant international upheaval has lasted for four years and that “The oil markets have a history of navigating through geopolitics, wars, economic crises, and financial disruptions.” The bigger current trends come from the demand side and from the “broader macro-economic environment.”

The continuation—and intensification—of global disruptions has created some wide disparities in trade and in demand, she said, but the industry’s commitment to capital discipline has been a constant everywhere, including the Permian Basin. “This includes maintaining financial strength, prioritizing shareholder payouts, and expediting investments in promising low-carbon solutions,” she explained.

Pivoting to natural gas, Deloitte sees continuing strong demand for U.S. LNG, “with exports rising to record levels [8.6 million metric tons exported in December 2023], spurred by the continued demand from Europe, which accounted for 61 percent of the U.S. LNG exports in December 2023 (Reuters, “U.S. Was Top LNG Exporter in 2023 as Nation Hit Record Levels,” January 2024).

Technology to Boost Production

With rig counts in flux and the best prospects in the Permian mostly drilled up, Thomas sees producers leveraging technology, specifically Generative AI, to maximize new and existing wells—a trend that will pick up more speed in the coming years.

AI’s ability to speedily integrate a long list of variables pertinent to many types of decision-making processes empowers it to “generate comprehensive maintenance plans, task lists, and real-time recommendations to increase efficiency and reduce execution costs/timelines,” she observed. “When used for predictive maintenance, this reduces unplanned downtime, minimizes resource waste caused by equipment failures, and extends the life span of assets which ultimately leads to cost savings and safer working environments over the use of machine learning alone. For instance, a 200,000-bpd offshore platform experiencing about 12 hours of unplanned downtime can result in deferred production worth up to $8 million.” (Deloitte, 2024 Oil and Gas Industry Outlook, December 2023).

The use of AI extends beyond day-to-day operations, extending deep into planning and analysis. “Some companies are leveraging AI-based advisors to process incredible quantities of data, including geological and subsurface information such as seismic surveys, well logs, and historical drilling records, leading to optimized drilling processes and providing Generative AI interfaces which allow users to utilize natural language to query and interact with the data [ibid].”

Thomas added that, due to its high level of activity and infrastructure, the Permian Basin is “a ripe testing ground for incorporating the use cases for AI adoption.” She referred to an EIA report from 2023 declaring that technology advances had led to record productivity in new Permian wells during the 2021 calendar year.

Challenges for 2024 and Beyond

The entire sector—producers, service companies, midstream and more—face huge challenges in the coming years. Thomas quoted figures from the Deloitte 2024 outlook as expecting the global upstream industry to generate between $2.5 trillion and $4.6 trillion in hydrocarbon-based free cash flows from 2023 to 2030. But not all of that goes to investors or to boosting production.

Mining further from the report, she pointed out that some of that profit will be drained into investment in greener technologies over that time. “However, future capital allocation remains a major challenge for the upstream sector as companies are expected to scale low-carbon innovation while maintaining profitability and shareholder value. In fact, around 60 percent of our surveyed O&G executives supported investments in low-carbon projects if the internal rate of return [IRR] from these projects exceeds 12-15 percent. However, this expected return is about 1.5–2 times the returns achieved by renewable power projects (primarily solar and wind).”

And as that new technology spurs production, midstream companies will face many permitting obstacles to staying ahead of the attendant growth in takeaway capacity requirements, Thomas said.

Ironically, those tech-based production boosts may come back to bite service companies, she said. “The heightening efficiency due to longer laterals, multi-pad drilling, higher usage of proppants, etc., have increased production without a similar increase in drilling activity.” There are also supply chain difficulties in consumables such as bits, drilling fluids, and tubulars, along with equipment.

Over its more than a century as a provider of energy to the United States and the world, the Permian Basin has weathered wars, both world and regional, as well as overinvestment, underinvestment, environmental challenges, public relations onslaughts, and a host of other issues. But the coming decade may prove to be its most challenging time yet as the hydrocarbon industry works to find its place in a new world energy order. Yet its track record says it should be ready for the fight.

The post 2024 Outlook: Mixed, But Promising appeared first on Permian Basin Oil and Gas Magazine.